Tokenomics

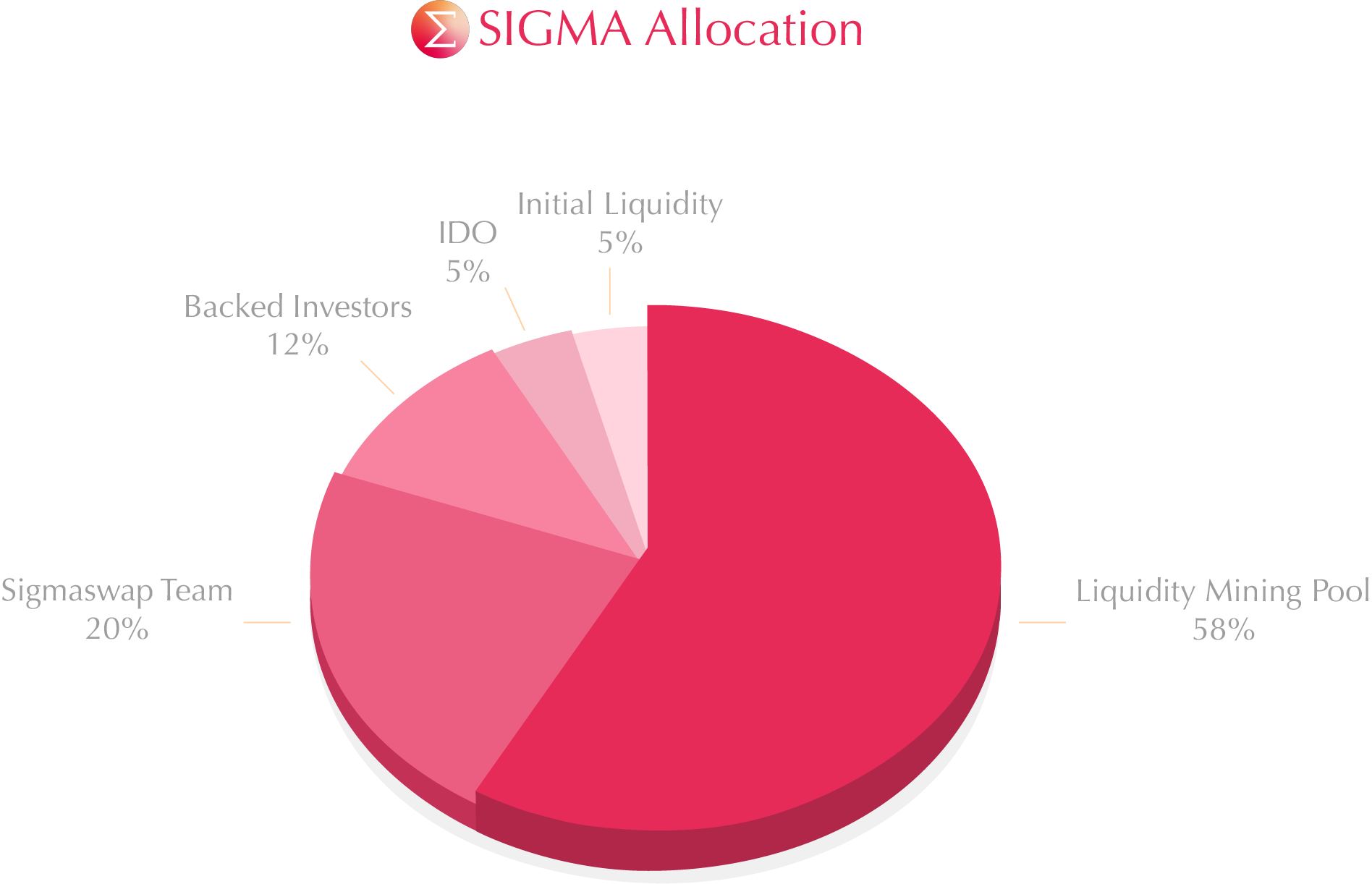

Allocation & Distribution

Locked Tokens

- 12% of SIGMA tokens are locked for vesting for backed investors who helped support the protocol since the beginning.

- 20% of SIGMA tokens are locked for the Sigmaswap team.

For more detail, go to Vesting.

Initial DEX Offering (IDO)

- 5% of SIGMA tokens are initially sold to the first group of Sigmaswap users. The fund collected is used as a capital to bootstrap the liquidity of the SIGMA token once it is open for trade.

Learn more about IDO-vesting.

Public Launch

- After the IDO is completed, 5% of SIGMA tokens are then transferred into the liquidity pool for trading, first on the Sigmaswap. The launch includes the features of liquidity provision, liquidity mining, and staking.

Liquidity Mining

- 58% of SIGMA tokens can only be mined through the Sigmaswap Liquidity Mining Pool.

Emission Rate

note

The circulating supply below might not be accurate due to the Deflationary Mechanisms and Vesting.

Per second

The table includes the initial liquidity(5%) and liquidity mining emission(58%).

| Months after release | Emission rate/second | Emission rate/month | Estimated circulation |

|---|---|---|---|

| 1 | 0.7 | 1,814,400 | 6,814,400 |

| 2 | 0.7 | 1,814,400 | 8,628,800 |

| 3 | 0.7 | 1,814,400 | 10,443,200 |

| 4 | 0.7 | 1,814,400 | 12,257,600 |

| 5 | 0.7 | 1,814,400 | 14,072,000 |

| 6 | 0.7 | 1,814,400 | 15,886,400 |

| 7 | 0.7 | 1,814,400 | 17,700,800 |

| 8 | 0.7 | 1,814,400 | 19,515,200 |

| 9 | 0.7 | 1,814,400 | 21,329,600 |

| 10 | 0.7 | 1,814,400 | 23,144,000 |

| 11 | 0.7 | 1,814,400 | 24,958,400 |

| 12 | 0.7 | 1,814,400 | 26,772,800 |

| 13 | 0.7 | 1,814,400 | 28,587,200 |

| 14 | 0.7 | 1,814,400 | 30,401,600 |

| 15 | 0.7 | 1,814,400 | 32,216,000 |

| 16 | 0.7 | 1,814,400 | 34,030,400 |

| 17 | 0.7 | 1,814,400 | 35,844,800 |

| 18 | 0.7 | 1,814,400 | 37,659,200 |

| 19 | 0.7 | 1,814,400 | 39,473,600 |

| 20 | 0.7 | 1,814,400 | 41,288,000 |

| 21 | 0.7 | 1,814,400 | 43,102,400 |

| 22 | 0.7 | 1,814,400 | 44,916,800 |

| 23 | 0.7 | 1,814,400 | 46,731,200 |

| 24 | 0.7 | 1,814,400 | 48,545,600 |

| 25 | 0.7 | 1,814,400 | 50,360,000 |

| 26 | 0.7 | 1,814,400 | 52,174,400 |

| 27 | 0.7 | 1,814,400 | 53,988,800 |

| 28 | 0.7 | 1,814,400 | 55,803,200 |

| 29 | 0.7 | 1,814,400 | 57,617,600 |

| 30 | 0.7 | 1,814,400 | 59,432,000 |

| 31 | 0.7 | 1,814,400 | 61,246,400 |

| 32 | 0.7 | 1,814,400 | 63,060,800 |

tip

The total emission period could be extended by the overall tokenomic system, deflationary mechanisms, and future events in the Sigmaswap protocol.

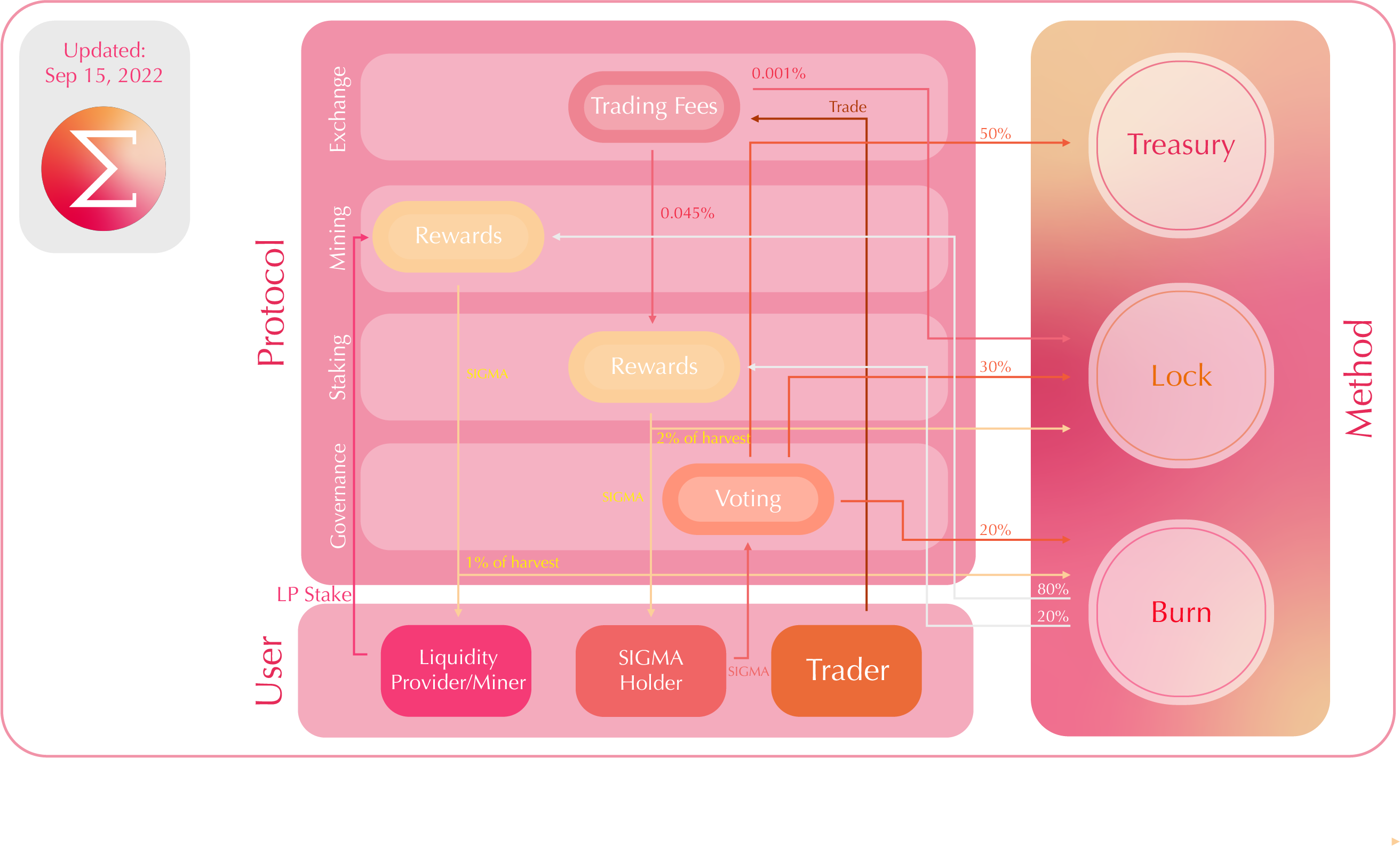

Deflationary Mechanisms

Sigmaswap protocol is aware of inflationary situations that possibly occur. Hence, we introduce methods to decrease in circulation.

Burn

Sigmaswap implemented buyback & burn method. The amount of tokens burned can be mined again in the Sigmaswap Liquidity Mining Pool and the Staking Pool. The collected fund is sent to the liquidity mining reward contract for 80% and to SIGMA staking reward for 20%. This can result in extending the period of SIGMA emission (from 32 months at setting).

Unopenable Lock

The idea of an unopanable lock is like life imprisonment in reality. Sigmaswap has a buyback & lock method to decrease the total supply of SIGMA. These locked tokens are forever imprisoned in an immutable and uncontrollable contract.

Treasury

Treasury is a storage of tokens collected from fees in any protocol services, resulting in reduced circulating supply. The fund is managed by the Sigmaswap Governance.

Verify the Circulating Supply

The easiest way is to check at Sigmaswap Landing Page.

However, there could be errors. To confirm that the circulating SIGMA supply shown anywhere is correct, head to the SIGMA token address on Hashscan and see how much SIGMA is minted. Then perform a subtraction by the sum of (locked tokens in vesting(team, investors, IDO) + treasury + unopenable locked token + buyback address). That is the actual total amount of SIGMA in circulation.

note

Check all the deployed token and contract addresses here.

Fees

Fees in Sigmaswap play an important role in controlling SIGMA supply. Read more on Fees.