Risks

Sigmaswap is a decentralized protocol which implies that the protocol lacks the ability to manipulate the system or any feature deployed. Users must acknowledge and understand all the risks before participating in any event. All features of Sigmaswap bring forth their participants options to optimize their finance(e.g. selecting tokens and amounts to swap, selecting pools to provide liquidity, selecting desired reward tokens to claim from the mining pool, and more).

Sigmaswap encourages all individuals in the DeFi space to learn and understand the system prior to decision making.

Traders

Slippage

Slippage indicates the difference between the expected transaction price and the actual transaction price. It correlates with the liquidity density in each pool. The higher the liquidity(reserve), the better the trading depth and the lower the slippage. Once a transaction occurs, resulting in a change in the reserve of an asset in the pool, the actual transaction execution price of the asset will change which causes a slippage. Therefore, the larger the transaction volume and the deeper the destruction of the liquidity reserve of the capital pool, the higher the slippage. In practice, users who perform a large trade in a low-liquidity pool could receive less the output token as they expected since their transaction significantly brings up its price, or simply means that they buy the asset at a higher price than average. As the terms are often used interchangeably, slippage and price impact, in order to clarify, the change in reserve(LP) is called "slippage", and the change in a token's price after the trade is called price impact.

Price Impact

As mentioned above, price impact is the change in token prices after a trade. This depends on the trading volume and liquidity volume. In practice, there is a case of transaction ordering where two people swap the same token with the same currency input and amount. The one who submit the transaction a fraction of a second faster and get finalized first would receive more tokens. Then if his/her trade created a price impact. According to the result, the second person who gets the transaction approved and finalized shortly after would be affected by the price impact, resulting in having less output token compared to the first person. From the example, this could lead to significant loss if the case happens with a large amount of capital involved and/or with high price impact. Note that it appears when both trades occur concurrently or almost to not able to see the difference in prices on the interface.

Liquidity Providers

Impermanent Loss

Impermanent loss (IL) is commonly associated with liquidity provision and yield farming. In essence, impermanent loss is a temporary loss of funds occurring when providing liquidity. It occurs when there is change in asset ratio of a paired token (LP token).

Because all assets have their own price values, the change in ratio directly affects the price, and it can also be explained that the change in price is called an impermanent loss. The IL begins into effect once a user provides liquidity almost immediately as all asset prices are always moving in reality.

Since there are possibilities that prices can always return back to the initial exchange price in the future, the impermanent loss is canceled if your asset is priced the same as the initial deposit price.

Impermanent loss is called impermanent as the ratio of a paired asset can always return to where each user entered providing their liquidity.

note

Check out this article about impermanent loss from Binance Academy to learn more.

Impermanent Loss Calculation

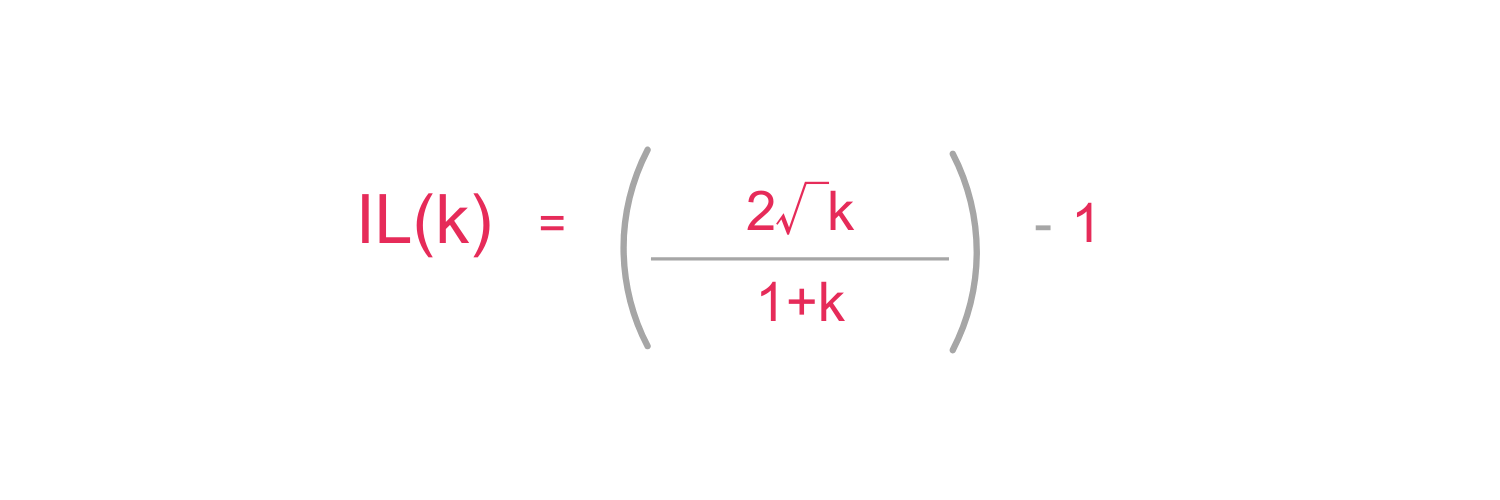

In case a user desire to know more how it works, the formula is as follow:

In this formula, the variable k refers to the change ratio from the initial to the future price. For example, if an asset increases by 10%, k would have a value of 1.1

Once you have the value of impermanent loss for the given change k, you can multiply that percentage by the initial value to get the actual dollar amount.

For example, if the impermanent loss is at 0.6% and the initial price of the asset is US$1000, then the actual liquidity pool impermanent loss is US$1000 * 0.6% = US$6

note

For your convenience, please use impermanent loss calculator for calculation.